This document is designed to give a few headline points to consider when negotiating reviews. Whether you’re conducting your own rent review negotiations or you’ve instructed a chartered surveyor to negotiate for you, it can help to have a grasp of the fundamentals.

Please keep in mind that I can accept no responsibility either implicitly or explicitly for what follows. Always obtain professional advice before proceeding.

It’s always best to start by thoroughly reading through your lease. Be sure to understand the main clauses such as –

If your landlord has contacted you about the rent review, first check the exact date of the review and most importantly, how should the review process be instigated. Seek legal advice to ensure your response complies with the strict notice requirements and the timescale for responding to the landlord.

Even in leases without formal review mechanisms, it’s wise to engage early with the landlord or their agent. This proactive approach allows insight into the landlord’s intentions and provides time to gather evidence.

Once you confirm a pending rent review, assess your property’s size. Different property types follow different measurement practices–

Gross Internal Area (GIA) for industrial spaces – this means measuring everything inside the premises, including the pillars and the toilets.

Net Internal Area (NIA) for offices and some leisure spaces – essentially this means all the ‘useable space’ within the property. Areas which have a restricted head hight, structural parts and the toilet areas are removed.

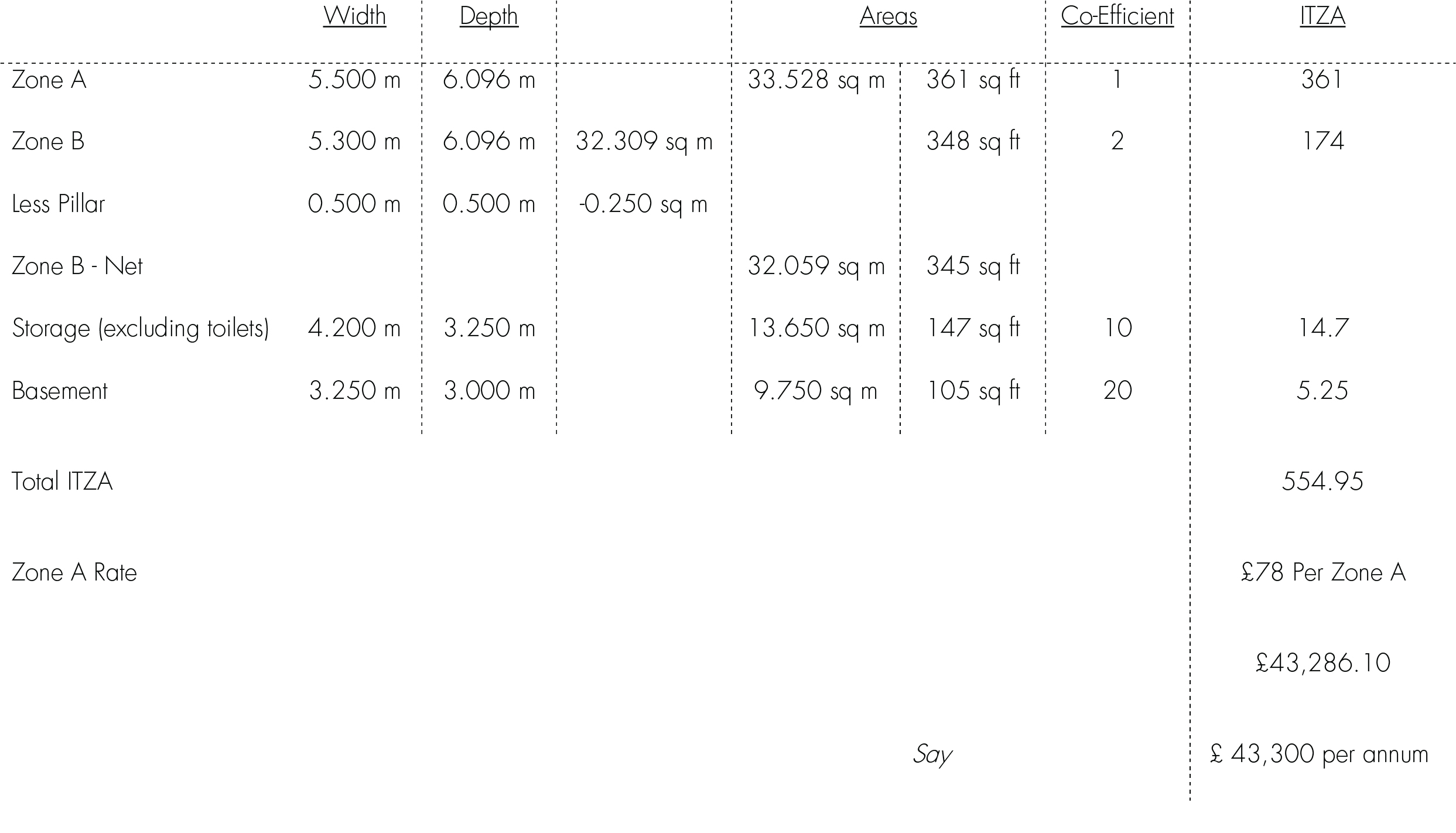

Most retail property is measured on an ‘In Terms of Zone A Basis’ (ITZA). This places different rates on each area.

Here’s an example od an ITZA area:

Familiarise yourself with these standards and consider purchasing a measuring laser for accuracy.

Your lease will dictate how the property is to be valued. This could involve inflation-based reviews, a profit generating assessment, or open market rental value calculations based on comparable transactions adjusted for property and lease specifics.

Look at the rent review terms and check if your lease mandates upward-only rent reviews. Consider the different valuation assumptions and disregards listed in the lease. These will state items such as the need to value any improvements and disregards factors such as rent-free periods on comparable transactions. The assumption and disregards can have a large impact on the rental valuation.

Consult neighbouring tenants about their rent agreements to gather comparable transaction data. Focus on recent, similar transactions within six months of the review date for a stronger argument.

As part of this exercise, ask them what rent they are paying, when it was agreed and if there were any incentives such as rent free.

After analysing your lease, property size, and comparable transactions, you should make the necessary adjustments to determine a reasonable new rent. The adjustments to the comparable transactions you may need to make are whether your lease is more onerous (or more flexible); is the term longer or the repairing covenant different?

Once you have assessed the rental value, double check whether the proposed figure aligns broadly with market what the market is offering.

Many tenants would like to convince themselves that the review process is only for the landlord to pursue. But then are shocked when the landlord pushes for a higher rent a few years after the review date. The rent review date is set in stone and most leases allow the landlord to instigate the process years after the review and allow the landlord to charge for the rental uplift from the review date.

The landlord will most probably present a biased account of what the rental version should be. Very often they will advocate an uplift when none should be due.

Recognise that rent review processes are negotiable, and landlords may advocate for higher rents. Engage in negotiations to reach a mutually beneficial outcome, standing firm on justified positions

Leases often permit third-party involvement for dispute resolution. While this option exists, it’s time-consuming and costly. Consider it only after attempting negotiation with the landlord.

Landlords often apply to third party just to get the tenant moving. Third party, like arbitration, is a long process taking many months. Throughout the process, you can still negotiate with the landlord – something I would encourage you to do.

You may find yourself in the situation where the landlord has applied to third party and you need to appoint a surveyor, before committing yourself to the process. In this instance, you should instruct a surveyor to at least carry out an initial assessment.

Be proactive in understanding local market trends and your lease terms. If a rental uplift is expected, consult your accountant to provision for any accrued liability in your accounts.

For further support or advice, call me for a complimentary initial assessment on 020 7101 4550.